Average Accounts Receivable Formula

Web Average Collection Period Formula Average accounts receivable balance Average credit sales per day. The different important points related to the Average Payment period are as.

Accounts Receivable Turnover Ratio Accounting Play

Aging Buckets The other measure is the percent of accounts receivable in each aging bucket for instance 0-30 days 31-60 days 61-90 days etc.

. You can ensure clients pay the total amount due in a timely manner and improve your. Web Accounts Receivable Turnover Days Accounts Receivable Turnover Days Average Collection Period an activity ratio measuring how many days per year averagely needed by a company to collect its receivables. Web Average Collection Period Formula.

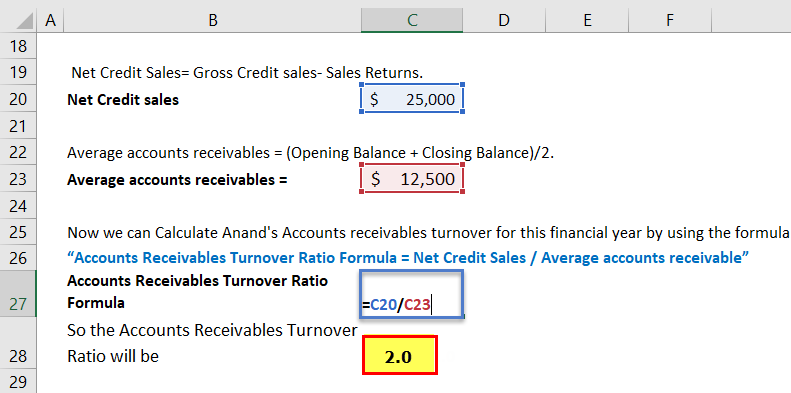

Net Annual Credit Sales Average Accounts Receivables Accounts Receivables Turnover. In the first formula to calculate Average collection period we need the Average Receivable Turnover and we can assume the Days in a year as 365. Web To calculate the accounts receivable turnover ratio we then divide net sales 60000 by average accounts receivable 2000.

Accounts receivable Annual revenue x Number of days in the year Accounts receivable days. Has an accounts receivable turnover ratio of 30. 200000 x 1 175000 x 5 100000 x 10 75000 x 15.

Web Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time generally monthly quarterly or annually divided by two. Creditor days is. Web Download Free Accounts Receivable Template in Microsoft Excel for easily maintain debtors receivable ledger according to Indian Accounting System.

They are categorized as current assets on. DSO Accounts Receivables Net Credit Sales X Number of Days. Web Cash Conversion Cycle - CCC.

Web A third type of accounts receivable analysis is ratio analysis. This means XYZ Inc. The first formula is mostly used for the calculation by investors and other professionals.

The cash conversion cycle CCC is a metric that expresses the length of time in days that it takes for a company to convert resource inputs into cash flows. Generally the average collection period is calculated in days. The formula for calculating the AR turnover rate for a one-year period looks like this.

This is calculated using the following formula. 60000 2000 30. Web The formula for accounts receivable days is.

Web 40-50 days for an Average performing Medical Billing Department. Web An accounts receivable aging report lists unpaid customer invoices or a companys accounts receivable by periodic date ranges. 60 days or more for a Below Average Medical Billing Department.

Web 73500 23250. Net Annual Credit Sales Beginning Accounts Receivable Ending Accounts Receivable 2. In other words this indicator measures the efficiency of the firms collaboration with clients and it shows how long on average the companys.

Alternative formula Average collection period Average accounts receivable per dayaverage credit sales per day read more and inventory processing period etc. The company must calculate its average balance of accounts receivable for the year and divide it by total net sales for the year. It uses the following formula.

If a company has an average accounts receivable balance of 200000 and annual sales of 1200000 then its accounts receivable days figure is. Given the above data the DSO totaled 16 meaning it takes an average of 16 days before receivables are. Measuring Medical Accounts Receivable.

Average accounts receivable Annual sales 365 Days 50 Days collection period. The accounts receivables Accounts Receivables Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. Web The formula to calculate Accounts Receivable Turnover is to add the beginning and ending accounts receivable to get the average accounts receivable for the period and then divide it into the net credit sales for the year.

Fixed Assets Turnover Ratio 316 4 Accounts Receivables Turnover Ratio. Web To determine how many days it takes on average for a companys accounts receivable to be realized as cash the following formula is used. Web Average collection period 365Accounts Receivable turnover ratio.

Thirty is a really good accounts receivable turnover. Lets talk about how a company calculates its average collection period. The formula looks like the one below.

D5-SUMH5J5L5N5P5R5T5V5X5Z5AB5AD5 We thank our readers for liking sharing and following us on different social media platforms. The higher this ratio is the faster your customers are paying you. The most commonly used ratio is the accounts receivable collection period which reveals the number of days that an average customer invoice remains outstanding before it is paid.

Compute And Understand The Accounts Receivable Turnover Ratio Slides 1 18 Youtube

Accounts Receivables Turnover Ratio Formula Calculator Excel Template

Receivables Turnover Formula And Calculator

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

No comments for "Average Accounts Receivable Formula"

Post a Comment